Please Get Good Engagement Ring Insurance

There are endless reasons why you need to insure your engagement ring.

To name just a few that we’ve seen first hand over the years with clients:

Losing your ring, misplacing it while traveling, having it stolen, dropping it into a lake, accidentally garbage disposal-ing it, losing a stone, chipping a stone, and having to have it cut off by firefighters because you’re pregnant and your fingers are swollen (just to name a few).

More importantly, your engagement ring is likely one of the most expensive investments you’ll make in your lifetime. It only makes sense to protect it.

If this ring could talk it would say “Please insure me!”

So I’m not here to try to convince you that you need to insure your engagement ring–you absolutely do unless you’re prepared to replace it out-of-pocket– I’m here to tell you that getting just any old insurance policy is not enough. I’ve seen unfortunate things happen to good people who get bad insurance, and as a jeweler, there’s really nothing we can do about it, except give you the following advice:

Do Not Get Jewelry Insurance Through Your Home/Renter’s or Auto Insurance

Adding your engagement ring to an existing policy with an insurer you have an existing relationship may seem like the path of least resistance, but it’ll only end in heartache if you actually have to file a claim.

First off, they’ll say that they cover fine jewelry, but that coverage is for everything, not per piece. Take it from Consumer Reports:

“The average engagement ring costs $6,000 but most standard homeowners and renters insurance policies that cover jewelry limit that coverage to $1,000 or $2,000.”

Second: These are not jewelry people. Home insurance companies are experts in home insurance, just like car insurance companies specialize in cars. They are not fine jewelry experts and they don’t need to be because they will farm your claim out (which you unknowingly agreed to, it’s in the small print).

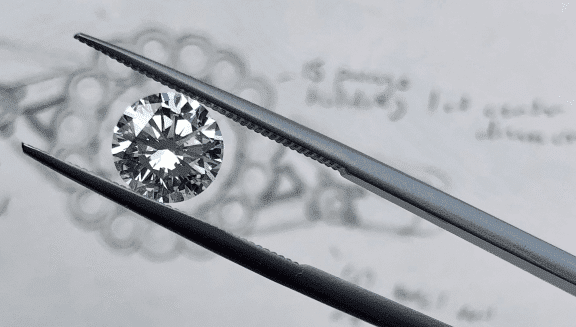

Would you really trust a car insurance company to find a stone exactly like this?

Here’s a real scenario I’ve seen with a client:

After a few years of wear, she hit and chipped her ruby center stone, so she reached out to the company her husband insured her ring through: a big car insurance company who advised her to send her ring to them, which she did. They pretty much held it hostage and told her that they would not pay her out, but would replace the center stone with a stone of their choosing. Reminder: this was a car insurance company. And they said that they could give her a comparable center stone to a rare-colored ruby that it took us over a month to source. I knew there was no way it would really be comparable, and it wasn’t, even if their “specialist” looked at the stone and said it was. This left her with no ring, no leverage, and zero recourse. We tried to rally for her, but there’s nothing we could do, especially against a massive company.

Moral of the story: if you think you’re going to win against a big insurance company, you’re wrong. Their job is to resolve your claim for as little expense to the company as possible. I have never personally seen these big companies make a decision in the interest of a client.

Insure Your Engagement Ring With A Jewelry Insurance Company

Take it from Consumer Affairs:

“Jewelry insurance is generally purchased as a part of your homeowners insurance or renters insurance. Though a basic amount is usually included as part of these insurance packages, it’s often wise to use stand-alone jewelry insurance as additional coverage.”

We recommend Jewelers Mutual. We don’t endorse them and we don’t get a kickback from them. They’re just an honest and trustworthy company that we’ve worked with on claims many times throughout the years and they’re who we recommend to all clients. They’re also who I use for my own jewelry.

What’s unique about them is that they pay out not only what your jewelry was appraised for, but also adjust for inflation. Now, I’m not saying that no one else does this, but I haven’t seen it.

Let’s say that ten years ago you paid $8,000 for your ring, and you’ve paid for $8,000 in coverage. If you don’t have good insurance, they can assess the value for much less, not even taking inflation into account. I seen this happen to a few clients. “How can they only give me $5,000 for a ring I bought for $10,000 ten years ago?” Because you agreed to it.

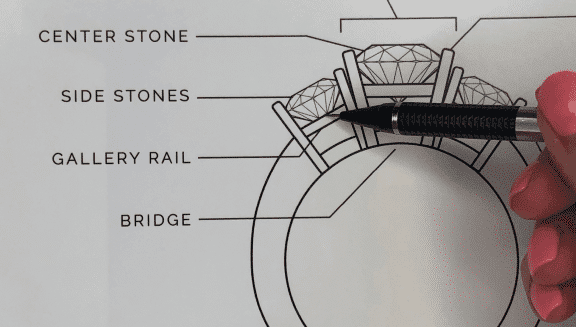

You have to find an insurer that guarantees to replace your ring with “like kind and quality” and are liable to fulfill that at current market conditions whether that was 5 or 15 years ago. I’ve only seen Jewelers Mutual actually do this. They are jewelry experts. This is what they do every day, and they’ve been in business for over one hundred years, for real. If anyone is going to determine what is comparable to a ring we’ve made, we trust them.

There is SO much to understand about the value and quality of fine jewelry materials. All stones are not created equal. A 1 carat diamond can easily be more valuable than a 3 carat, if you know what you’re looking for. An insurance company with an animal mascot does not necessarily know what they’re looking for.

How Much Does It Cost to Insure a Ring?

Here’s the thing: good jewelry insurance is no more expensive than bad insurance. The trap people get into is that it seems more convenient to just add your ring onto an existing policy. In the end, it’s not.

Generally, jewelry insurance will be about $10 for every $1,000 of your ring, so a $10,000 ring will cost you about $100 a year to insure properly. Really. That’s it. And if you’ve gone with really good insurance, that small yearly investment will save you BIG time in the end.

I’ve only really talked about replacements and value, but there’s a whole ‘nother aspect that most people don’t anticipate and that is replacing the sentimental value. If you lose or break your engagement ring, and you can’t get it replaced with something you like just as much…this is not a good situation for you and it will cause you stress and upset. If it was your responsibility to insure the ring and you didn’t do it right, I FEEL for you, but there isn’t much I can do.

Bottom line: jewelry insurance is like any other insurance: It’s not fun, it’s not exciting, and hopefully you’ll never have to use it… but when you do you’ll wish you had invested in the good stuff.

Imagine having your car stolen and your insurance replacing it with a bike. Or a car that looks great but has no engine. This is the equivalent of what can happen if you get bad insurance.

I’d love to save just one person from going down this road so please just do yourself a favor and protect your ring the right way! Any questions, leave them in the comments.

Comments